Upvote

6

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

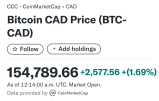

Everyone's favourite crypto just put in new ATH.

- Thread starter Nink

- Start date

Beers2Freedom

A Carney runs CLOWNADA

Ok, can someone explain to me how something with no physical representation can be worth $154 000+ CAD?

It doesn't exist in the real world, 1 of nothing is worth $154 000+ real dollars.

Also, why is it so volatile? It's price is very easily manipulated. Isn't crypto supposed to be more stable than physical currency?

It doesn't exist in the real world, 1 of nothing is worth $154 000+ real dollars.

Also, why is it so volatile? It's price is very easily manipulated. Isn't crypto supposed to be more stable than physical currency?

↑View previous replies…

Stop looking at it as a currency. It is not money.

A blockchain is a simply a self checking ledger where a network of computers essentially performs the transaction and records its then confirms the transaction occurred. The confirmation of the transaction keep getting recorded when a new block is added to the chain (every 10 minutes). When a block is found, the computer that found it gets the block reward. The on-chain asset we call bitcoin is actually the ticker 'BTC' which is the only vehicle that changes hands on the Bitcoin blockchain. This is the reward a bitcoin miner gets for finding the block. To find the block they lend their hardware to the network to perform and confirm transactions. There will only ever be a finite amount of BTC to ever exist.

Your bank is a ledger also that doesn't use cryptography to maintains its function because a bank wants to be able to reverse a transaction. it still uses computers. Sure you can get money to put in your hand but if everyone went to the bank all at once they don't have enough cash to put in everyone's hand. not much different than not physically holding a bitcoin.

Your name is also on your bank account. KYC is big for banks. Bitcoin doesn't need your name, your address etc and still performs much the same function rudimentary function of a bank (sending and receiving ei recording a transaction)

The value people prescribe to BTC is up to the market. You might otherwise consider the trade value of BTC to the trust the market has in the blockchain. Of course that supposes that anyone throwing money at is even understands what I've told you in this post.

Here is some food for thought. Remittances are expensive and take time. BTC cuts the cost and is far faster than conventional banks. Poor immigrants in the west send bitcoin back home cause the bank takes too much of a cut and takes too long.

A blockchain is a simply a self checking ledger where a network of computers essentially performs the transaction and records its then confirms the transaction occurred. The confirmation of the transaction keep getting recorded when a new block is added to the chain (every 10 minutes). When a block is found, the computer that found it gets the block reward. The on-chain asset we call bitcoin is actually the ticker 'BTC' which is the only vehicle that changes hands on the Bitcoin blockchain. This is the reward a bitcoin miner gets for finding the block. To find the block they lend their hardware to the network to perform and confirm transactions. There will only ever be a finite amount of BTC to ever exist.

Your bank is a ledger also that doesn't use cryptography to maintains its function because a bank wants to be able to reverse a transaction. it still uses computers. Sure you can get money to put in your hand but if everyone went to the bank all at once they don't have enough cash to put in everyone's hand. not much different than not physically holding a bitcoin.

Your name is also on your bank account. KYC is big for banks. Bitcoin doesn't need your name, your address etc and still performs much the same function rudimentary function of a bank (sending and receiving ei recording a transaction)

The value people prescribe to BTC is up to the market. You might otherwise consider the trade value of BTC to the trust the market has in the blockchain. Of course that supposes that anyone throwing money at is even understands what I've told you in this post.

Here is some food for thought. Remittances are expensive and take time. BTC cuts the cost and is far faster than conventional banks. Poor immigrants in the west send bitcoin back home cause the bank takes too much of a cut and takes too long.

Picard

Based Member

ever heard of Fortnite or Call of Duty skins? some of them sell for $40k+, they're purely digital, and usually repeatable. ever paid for a digital movie, book or music? you didn't receive something physical but you saw value and made the purchase. it's somewhat similar to this, but not a consumer item, but rather an investment vehicle (at least these days, might not have been the initial intent but it's how it has developed)

HuntStevenson

Based Member

As long as there's demand for it. It's capped at 21 million coins meaning they cannot create more of this digital coin. So I guess the hypothesis is that since the supply is constrained it's a good hedge against inflation.

I think of it as sort of like gold. Gold has no major industrial uses but for whatever reason it's always been this thing people want.

I think of it as sort of like gold. Gold has no major industrial uses but for whatever reason it's always been this thing people want.

Kraken to Offer Tokenized Stock Trading on Solana to Overseas Customers - Decrypt

Kraken will soon offer overseas customers the ability to trade U.S.-listed stocks and ETFs using the crypto exchange’s platform.