You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

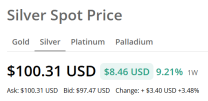

Silver hits $100 USD

- Thread starter Nink

- Start date

d01tg0d0wn

Based Member

anyone else try and source silver. I had a bullion dealer tell me min order is 10 000 now. You cant even get silver unless you drop 10 000

plan accordingly

plan accordingly

↑View previous replies…

brutana_dilewski

Exercise is for women.

I am pretty sure SilverGoldBull is still selling it. They had stock this morning on maples.

d01tg0d0wn

Based Member

100 dollar USD an ounce from what i hear is a good deal versus what is coming. This dealer i have dealt with before in Edmonton they are a small shop and they dont have anything left to sell not even gold. I didnt follow the fellows logic about guaranteed delivery due to supply constraints or whatever issue he was having. Sounded like you put 10 000 in and if he delivers say half the amount you got the rest of your money back. Apparently to order silver there is min orders on his side.

i would hate to be a bullion dealer right now. Changing fast

i would hate to be a bullion dealer right now. Changing fast

Last edited:

WHlTE_W4LKER

Baϟed Lad

Home_4

Active Member

KosherHiveKicker73

Active Member

brutana_dilewski

Exercise is for women.

Spoke with my old man yesterday - he hasn't steered me wrong yet. Every time I have listened to his investment advice, I made bank.

He told me that he expects silver to be equal with gold in the not too distant future. Of course that sounds nuts, but he hasn't been wrong yet....

Of course, this also means that the dollar will be shit in this condition. So there will be hobos everywhere. We will see i suppose.

He told me that he expects silver to be equal with gold in the not too distant future. Of course that sounds nuts, but he hasn't been wrong yet....

Of course, this also means that the dollar will be shit in this condition. So there will be hobos everywhere. We will see i suppose.

d01tg0d0wn

Based Member

normies havent caught on yet but when they do you know what will happen

↑View previous replies…

brutana_dilewski

Exercise is for women.

d01tg0d0wn

Based Member

@brutana_dilewski once normies figure it out there wont be any stopping the price. Wait till banks also start paying out because they cant deliver silver for silver certificates getting cashed in. People wont want the money they will want the asset. Dollars will be near worthless so why take dollars

d01tg0d0wn

Based Member

d01tg0d0wn

Based Member

use your credit cards to buy real silver and gold and then default??

lol

just like China does

lol

just like China does

brutana_dilewski

Exercise is for women.

not a bad idea

- buy with credit

- wait for silver to blow up

- sell a tiny fraction of what you bought to pay off the debt. keep the bulk.

- buy with credit

- wait for silver to blow up

- sell a tiny fraction of what you bought to pay off the debt. keep the bulk.

I do believe many places charge you extra if purchasing with CC.

↑View previous replies…

brutana_dilewski

Exercise is for women.

RightOfSask

Ga$$light R Us, Joyful Patriot Jabber

@brutana_dilewski

Pretty sure this counts as cash advance and they will hit you instantly with like a 20% rate.

Pretty sure this counts as cash advance and they will hit you instantly with like a 20% rate.

brutana_dilewski

Exercise is for women.

Home_4

Active Member

@RightOfSask I k ow if you transfer from a credit card it does, but I’ve never been dinged by doing it from the line of credit either

brutana_dilewski

Exercise is for women.

Meet The Man Who Bought $1 Billion In Physical Silver Before The Rally | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

KosherHiveKicker73

Active Member

Here is what is happening with the refiners. They are backlogged for 3-4 months, this makes it harder to sell junk silver which needs to be refined. I don't think this affects 999 fine silver though. Supply chain issues and market dysfunction can cause the silver price to rise violently.

www.phoenixrefining.com

www.phoenixrefining.com

Major Refineries Stop Taking Silver - Phoenix Refining

Some top refineries are refusing more silver scrap—see why and what alternatives scrap holders should explore.

MuchoRelax0

Active Member

Precious metals are very volatile, just a warning to anyone yoloing. That being said your investment portfolio should include a gold/precious metals

They are volatile, but with bitcoin sidelined by quantum concerns, maybe slightly less volatile than they have been.

d01tg0d0wn

Based Member

The fact countries are now declaring silver a strategic asset in my opinion means that silver is gonna remain in demand more and more as it is consumed more and more by industry

brutana_dilewski

Exercise is for women.

I have some confidence in silver because it is a finite resource that is rarely recovered after using in many industrial applications. Things can always change, but it looks like silver is becoming a key resource in several technology sectors because of its great conductivity and anti-microbial properties. If war happens to break out, silver consumption will increase as well.

Even when I feel skeptical, I still think it's a better long term investment than fiat dollars in the bank.

Even when I feel skeptical, I still think it's a better long term investment than fiat dollars in the bank.

d01tg0d0wn

Based Member

d01tg0d0wn

Based Member

108 USD and rising

Live Gold Spot Price Chart | BullionVault

Gold prices updated in real-time. Track the gold spot price in GBP, USD, EUR, JPY, AUD, CAD & CHF >>

www.bullionvault.com

brutana_dilewski

Exercise is for women.

I bit the bullet and scooped up another 90 oz over the weekend. Looks like the right call.

Do you buy in maples or bars?

brutana_dilewski

Exercise is for women.

maples. i don't buy bars anymore because of the prices. 10 oz isn't too bad but 100 oz bars now cost a small fortune and would be hard to sell unless the buyer has deep pockets. Best to default to 1 oz. I would love to trade some of my bars for smaller rounds.

Last edited:

d01tg0d0wn

Based Member